A look at recent news shows an alarming rise in fire incidents — from building fires to vehicle explosions and factory disasters, with forest fires becoming more common during the summer months. In India alone, over 7,500 fire cases were reported in 2022. Residential buildings were the most affected, accounting for 53.24% of the total incidents. Commercial buildings, manufacturing units, private vehicles, and government buildings also report significant fire risks.

These fires often result in tragic loss of life and extensive property damage, leading to severe financial strain on the affected individuals and businesses. With the increasing frequency and intensity of fires — driven by factors such as climate change or even negligence — fire insurance has become an essential safeguard for protecting property and assets.

What is Travel Insurance?

Travel insurance is a financial safety net designed to protect travellers from unforeseen events that may disrupt their journey. It covers a wide range of situations, from medical emergencies to trip cancellations, ensuring peace of mind while you explore.

What Is Fire Insurance?

Fire insurance is a specialized type of property insurance designed to cover losses or damages caused by fire. It protects insured properties, including buildings, structures, contents, and personal belongings, from fire-related risks and other perils. At its core, fire insurance provides a financial safety net, ensuring property owners don’t bear the full burden of catastrophic events like fires.

What are Benefits of Fire Insurance?

- Fire insurance offers various protections:

Types of Fire Insurance Policies

The type of fire insurance you need depends on your property and its specific risks. Common options include:

1.Standard Fire and Special Perils Policy: Covers fire-related damage and additional risks like lightning, explosions, natural disasters, riots, and vandalism.

2.Comprehensive Fire Insurance: Provides broader coverage, including protection from fire, natural disasters, accidental damages, and business interruptions.

3. Industrial Fire Insurance: Tailored for factories and industrial properties, covering large machinery, warehouses, and business interruptions.

Common Exclusions in Fire Insurance

While fire insurance offers extensive protection, it’s essential to understand what is excluded:

- Intentional Damage: Deliberate acts or arson are not covered.

- Wear and Tear: Damage from regular maintenance issues or poor upkeep is excluded.

- Non-Fire Risks: : Certain hazards, such as floods or theft, may require separate policies or additional coverage.

Current Scenario of Fire Insurance in India

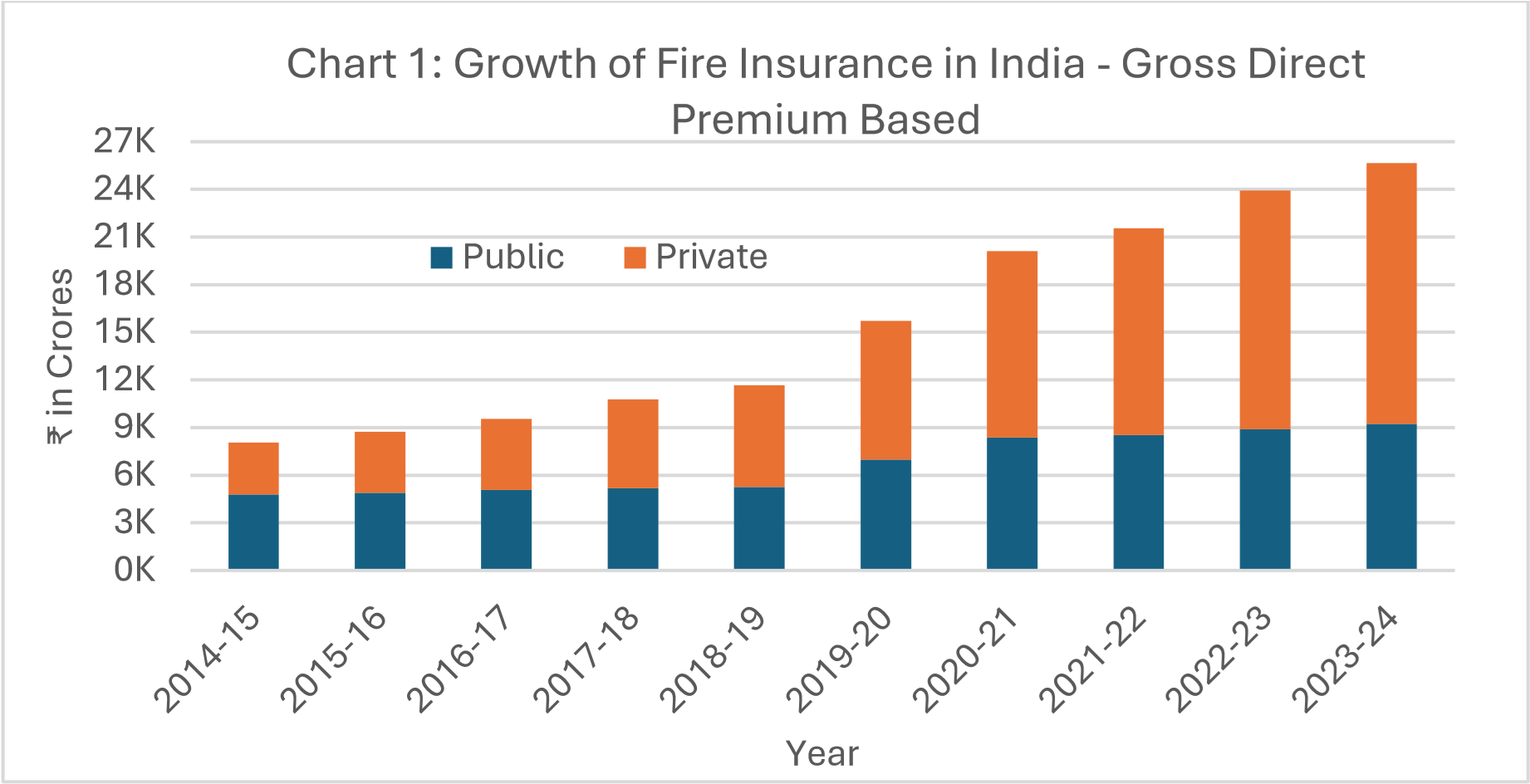

Chart 1 showcases the growth of fire insurance in India over the last decade, from 2014- 15 to 2023-24. The fire insurance sector has experienced a Compound Annual Growth Rate (CAGR) of 13.74% during this period, with the public sector growing at a modest 7.58% CAGR and the private sector showing a remarkable 19.62% CAGR.

Data Source: IRDAI Handbook on Indian Insurance Statistics 2023-24

Initially, in 2014-15, the public sector dominated the market, with a 60% share

compared to the 40% share of the private sector in the premium received towards

fire insurance coverage. However, in the year 2023-24, the private sector

contributed 64% of the total premium received of ₹25,666 crores highlighting the

significant rise in private sector involvement in fire insurance.

Within

the private sector, 5-6 key insurers dominate the market, contributing

significantly to premiums. While the public sector still holds a substantial

share, almost all private insurers offer fire insurance—except for standalone

health insurance (SAHI) companies.

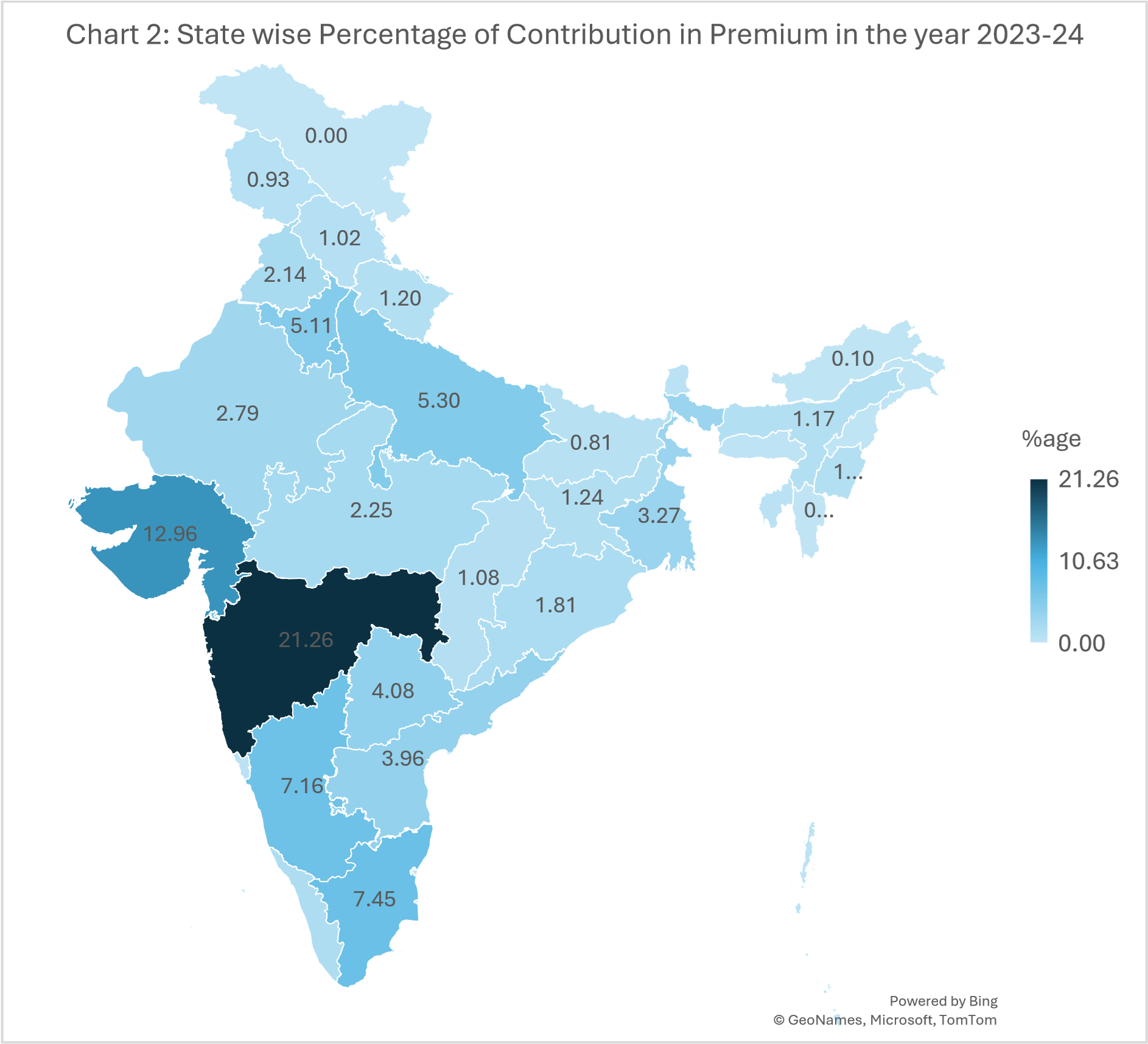

To understand more about the

distribution of fire insurance across States of India, Chart 2 is enclosed.

Data Source: IRDAI Handbook on Indian Insurance Statistics 2023-24

The state-wise distribution of fire insurance premiums reveals a noticeable

concentration in a few states. Maharashtra leads with the highest share,

contributing 21.26% of the total premium in 2023-24. Along with Gujarat

(12.96%), Tamil Nadu (7.45%), and Karnataka (7.16%), these states together

account for nearly 50% of the total fire insurance premiums.

In contrast,

states like Chhattisgarh (1.08%), Jharkhand (1.24%), Bihar (0.81%), and

Odisha (1.81%) contribute a fraction of the overall market. Other states such as

Delhi (6.32%), Uttar Pradesh (5.30%), Haryana (5.11%), and Telangana (4.08%)

contribute at moderate levels, further indicating the uneven distribution of

fire insurance coverage across the country.

Conclusion: A Smart Investment in Protection

With fire incidents on the rise globally, fire insurance is an essential

safeguard for property owners . Whether for a home, business, or industrial

setup, having the right coverage ensures quicker recovery from fire damage. In

light of increasing fire risks, particularly with climate change, it's important

to review your insurance coverage and ensure your property is adequately

protected. After all, it’s always better to be prepared than to face a financial

burden when the unexpected occurs.

The fire insurance sector in India is

expanding steadily, with private insurers leading the growth, while certain

states remain key players in premium contributions, highlights the potential for

greater penetration and awareness in underrepresented areas.

If you

haven’t yet secured fire insurance, consider doing so now. A small investment

today can save you from significant financial hardship tomorrow.

https://irdai.gov.in/ https://ncrb.gov.in/en/ADSI-2022

https://www.data.gov.in/ https://www.gicouncil.in/

About MicroInsurance Innovation Hub Foundation

The Microinsurance Innovation Hub aims to revolutionize the MicroInsurance

segment, especially in India and the Asia Pacific region. Based in Hyderabad, it

focuses on developing inclusive insurance solutions tailored to underserved

populations. By exploring product, technological, and process requirements, the

hub supports interested companies in penetrating this market segment. With a

mission to serve the underprivileged, it strives to enhance insurance

penetration and foster inclusive growth.

The Hub would work to support the

development of micro insurance in the Indian insurance industry through

exploring various aspects of this business, the product range, the technological

requirements, the process requirements, and the type of people required to

enhance penetration. For more information visit us at contact@microinsuranceinnovation.com

Disclaimer:

The Microinsurance Innovation Hub is a Section 8 company and has members who intend to foster financial inclusion of underserved and unserved communities through providing Insurance. The innovation hub will act as an open platform to the stakeholders of microinsurance. This Hub will exclusively work in the Microinsurance / Inclusive Insurance space in India and other regions. The information provided here is gathered from various sources and Microinsurance Innovation Hub doesn’t validate any data. The information here are intended solely for internal discussion purposes.